Account Data & Insights

This guide will walk you through the data and details included in an account page so you can find the detail you're looking for.

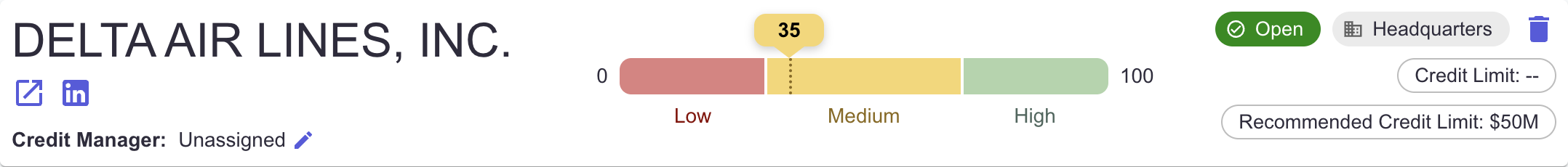

Header

The header is a static bar that carries across the pages within an account details. This gives you a quick glimpse into the overall details for this business.

It includes Company Name, Pulse Score, Office Type, Account Status, Web & Social Links, Credit Limit, and Recommended Credit Limit.

The "Credit Manager" field can be edited with the user who owns this account for easier management and to be used as filters on your dashboard list.

Overview

This section will outline the details listed in the "Overview" tab of an account.

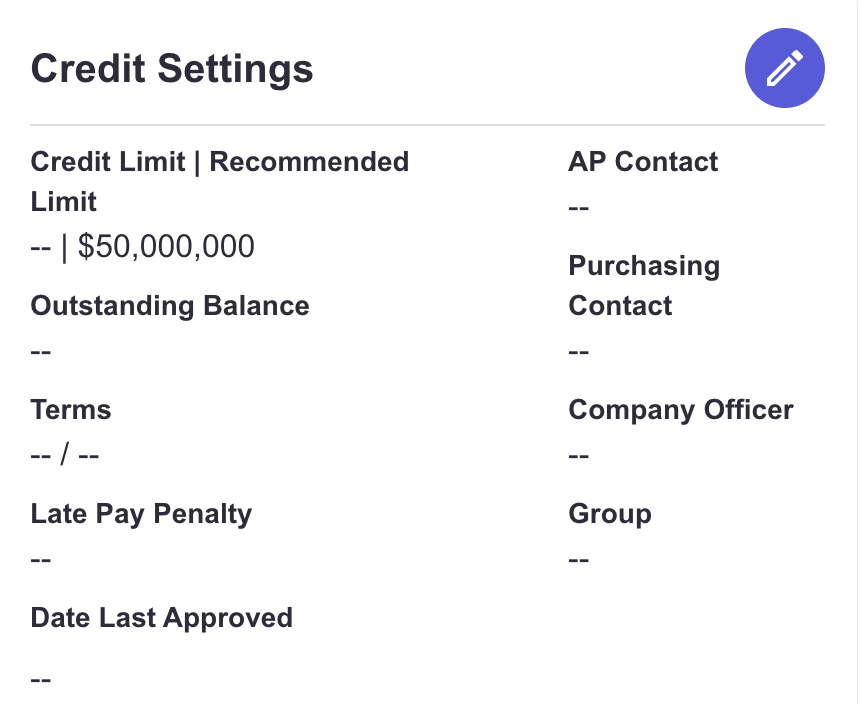

Credit Settings can be edited by your team to adjust per your agreement with the customer once credit is approved. Simply click the purple edit icon to make changes.

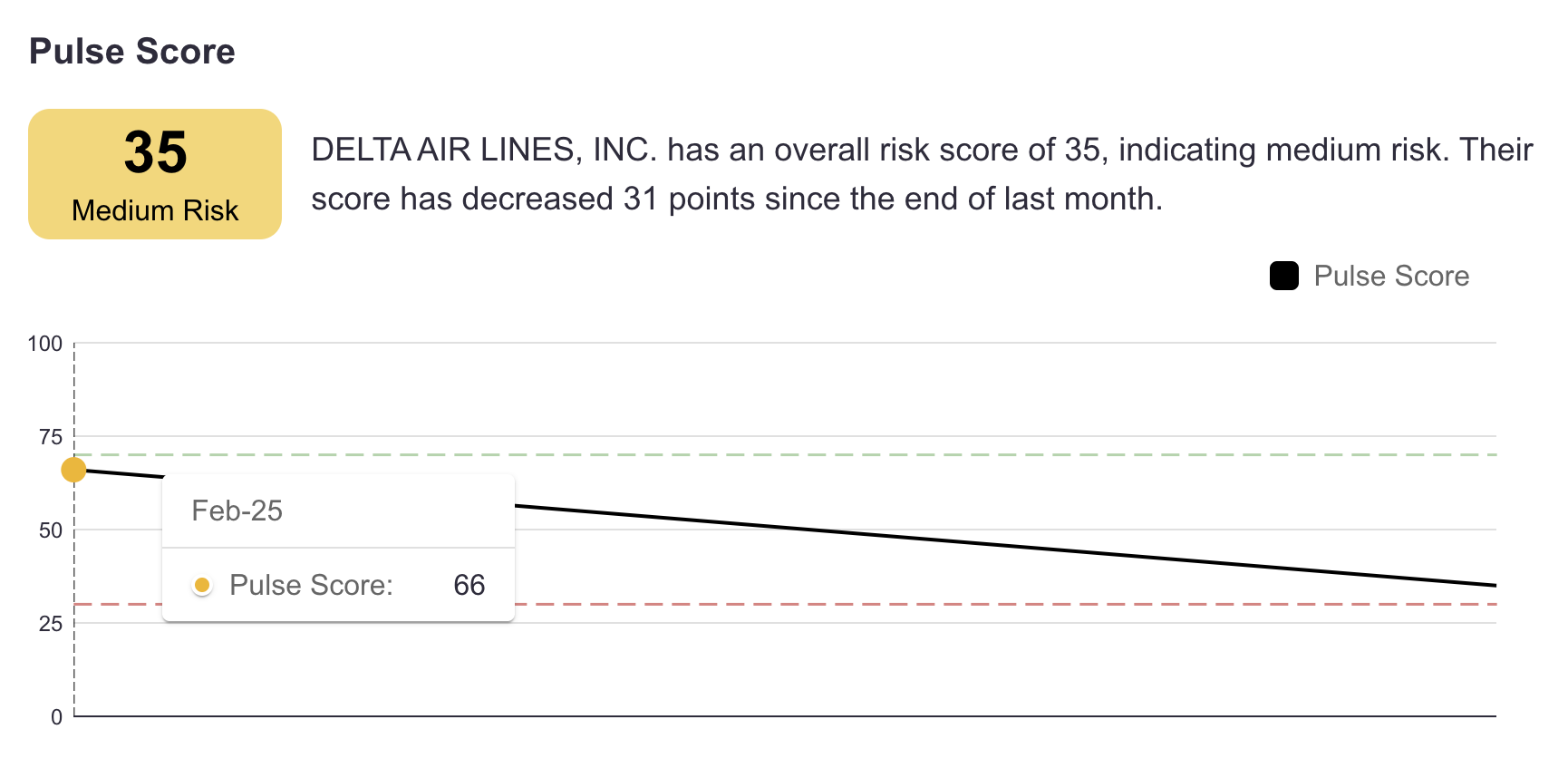

Pulse Score includes the current score and our assessment of this customer. The graph in this section includes a historical view since the company was added to your account. If you hover over the line, you will be able to see details pertaining to the previous or current scores.

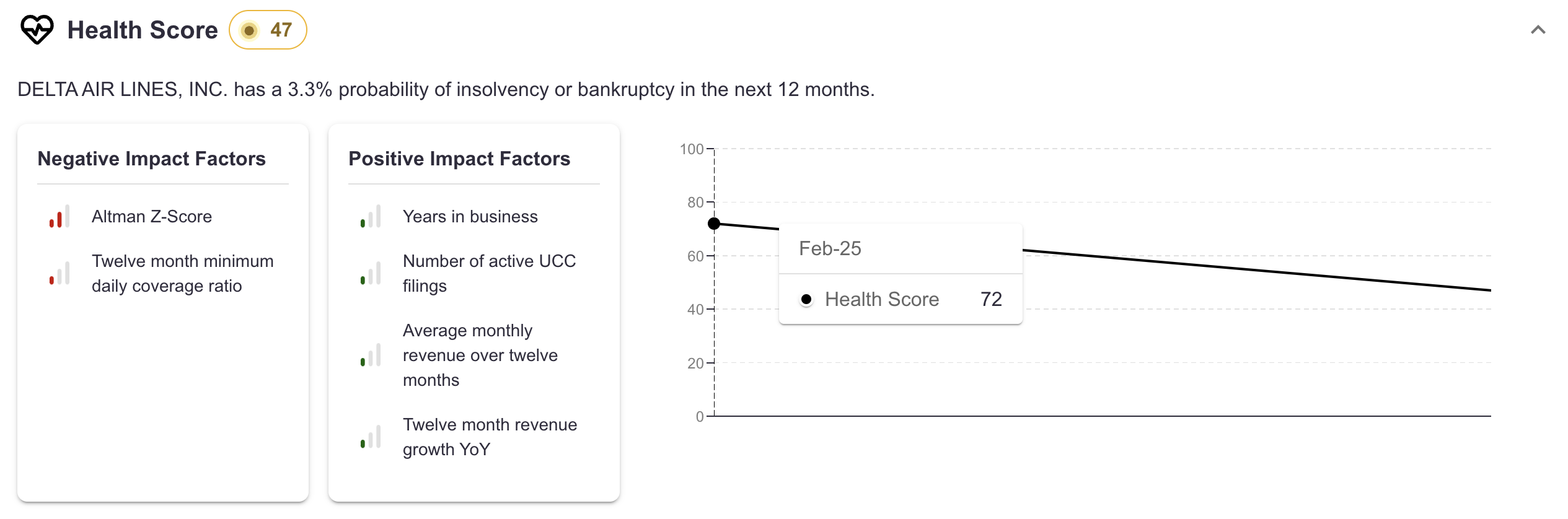

Health Score includes the current and historical assessments of this customer's probability of bankruptcy or insolvency within the next 12-month period. The Negative & Positive Impact factors are the events that we captured which support our assessment. These are ranked from low to high signal.

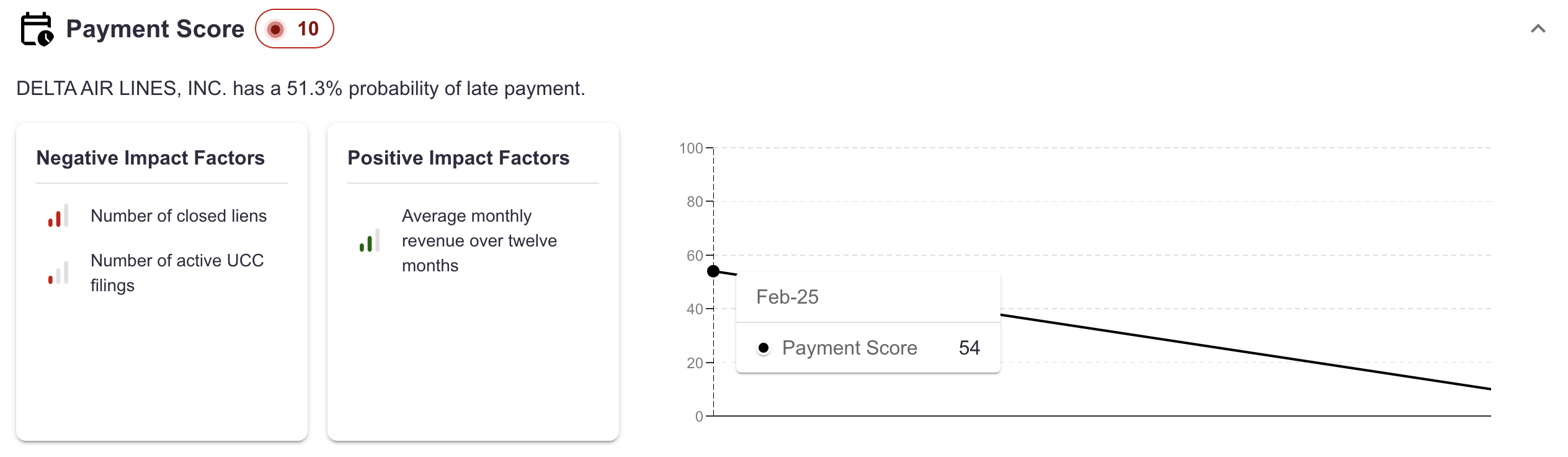

Payment Score includes the current and historical assessments of this customer's probability paying late. The Negative & Positive Impact factors are the events that we captured which support our assessment. These are ranked from low to high signal.

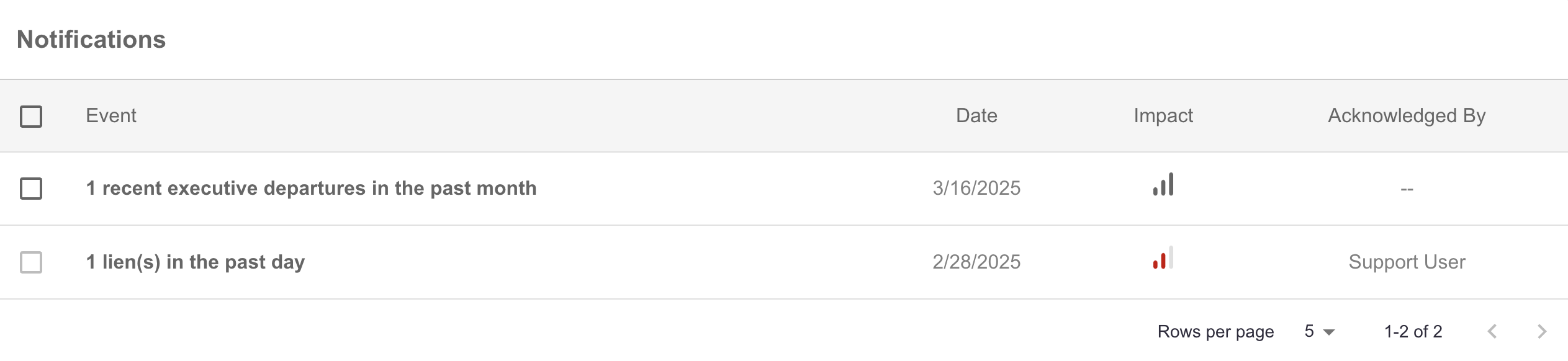

Notifications

This section displays notifications of key customer changes and events over time, providing you with a timeline of activity. These updates align with our daily and weekly email digests, which organize and deliver them directly to your inbox.

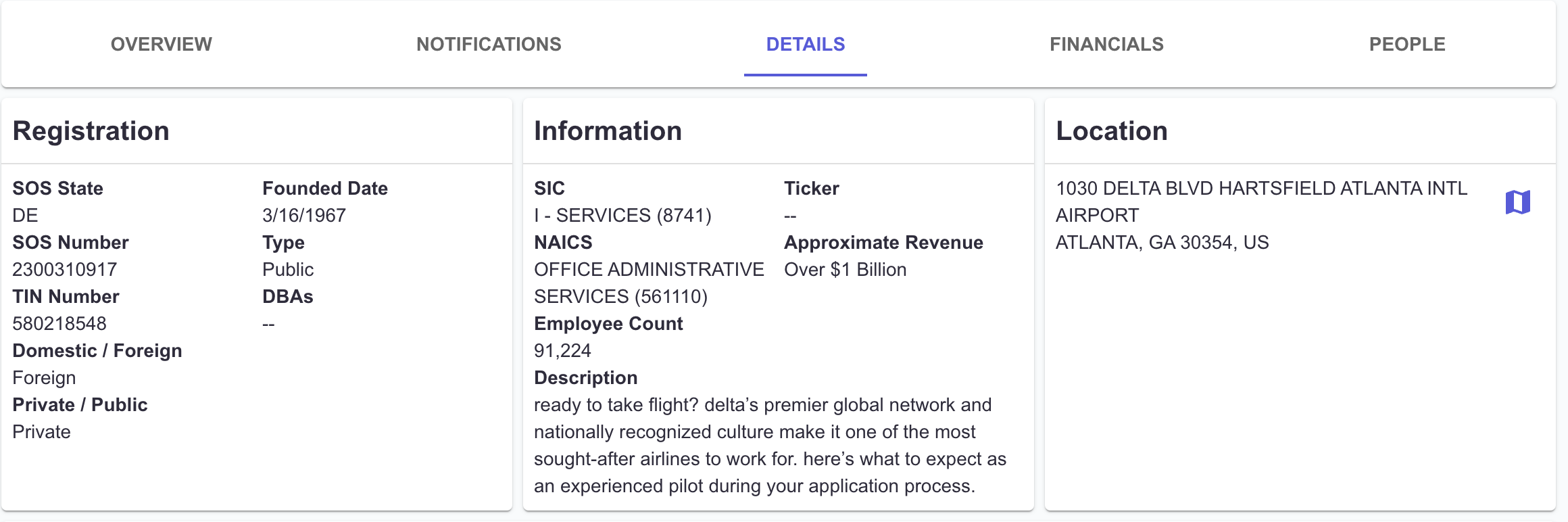

Details

This section provides essential company details and firmographics.

The "Location" section includes the company's address, along with a clickable icon that lets you view the location in street view.

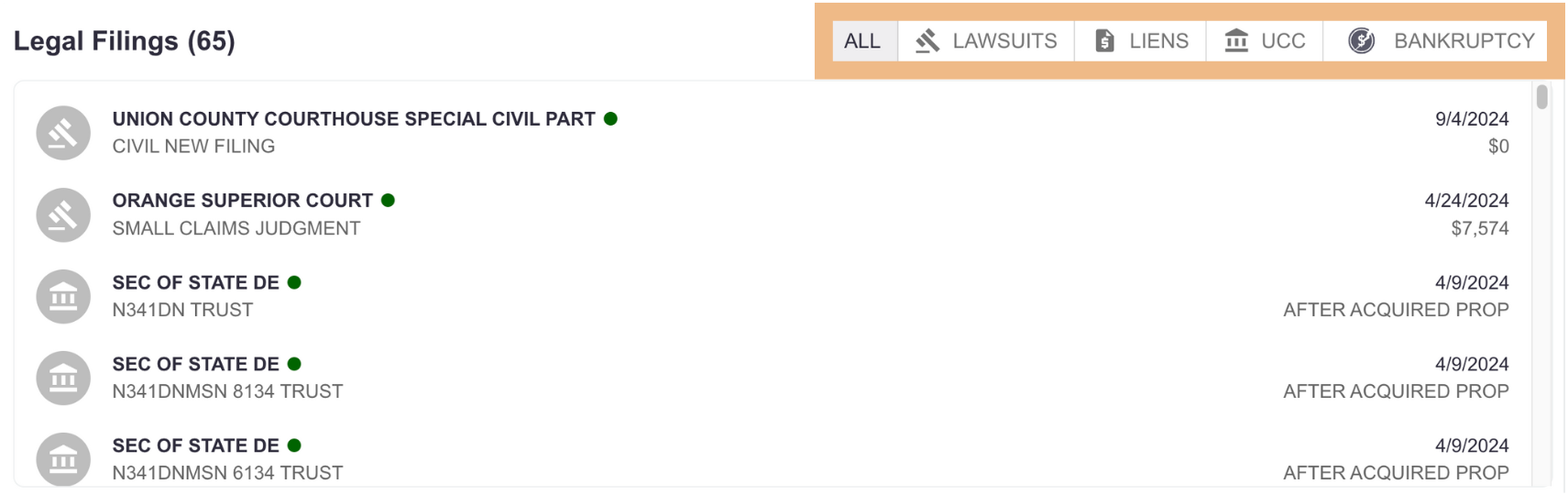

Legal Filings will be listed in the middle section. You can use the tags (highlighted below) to filter to specific types.

News & Media is included in this page. The articles are hyperlinked for easy access and assigned topics.

Affiliated companies will be listed in the final section, if applicable. If you need to run a report for a parent or subsidiary company, you can do so. Refer to our "Adding a New Account" guide for step-by-step instructions.

Financials

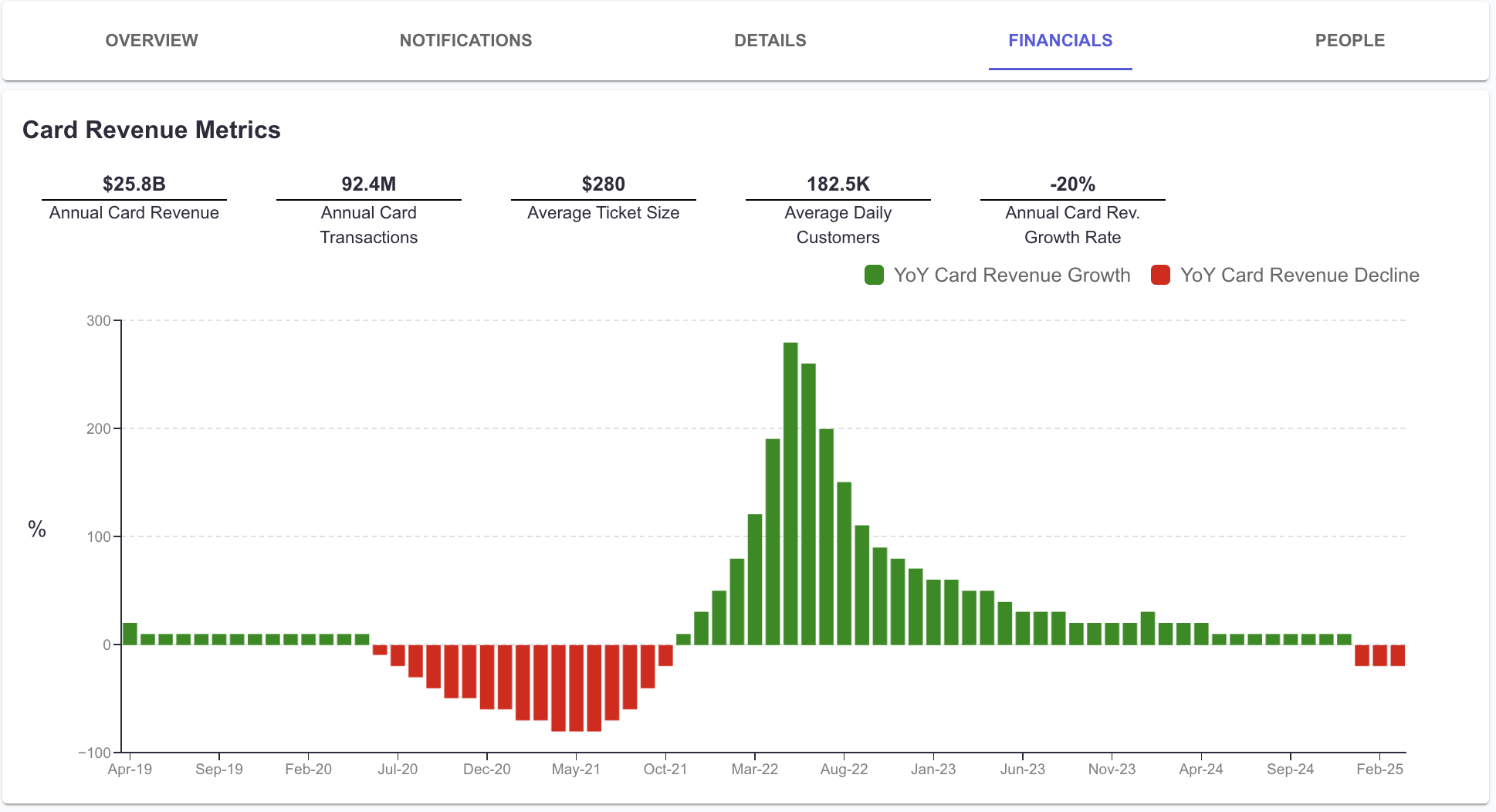

This section includes Credit Card Revenue and Trade Payment Behavior insights.

Credit Card Revenue appears first, featuring key metrics and a chart that provides a historical view of year-over-year revenue growth or decline. Hover over the bars to see detailed insights for each data point.

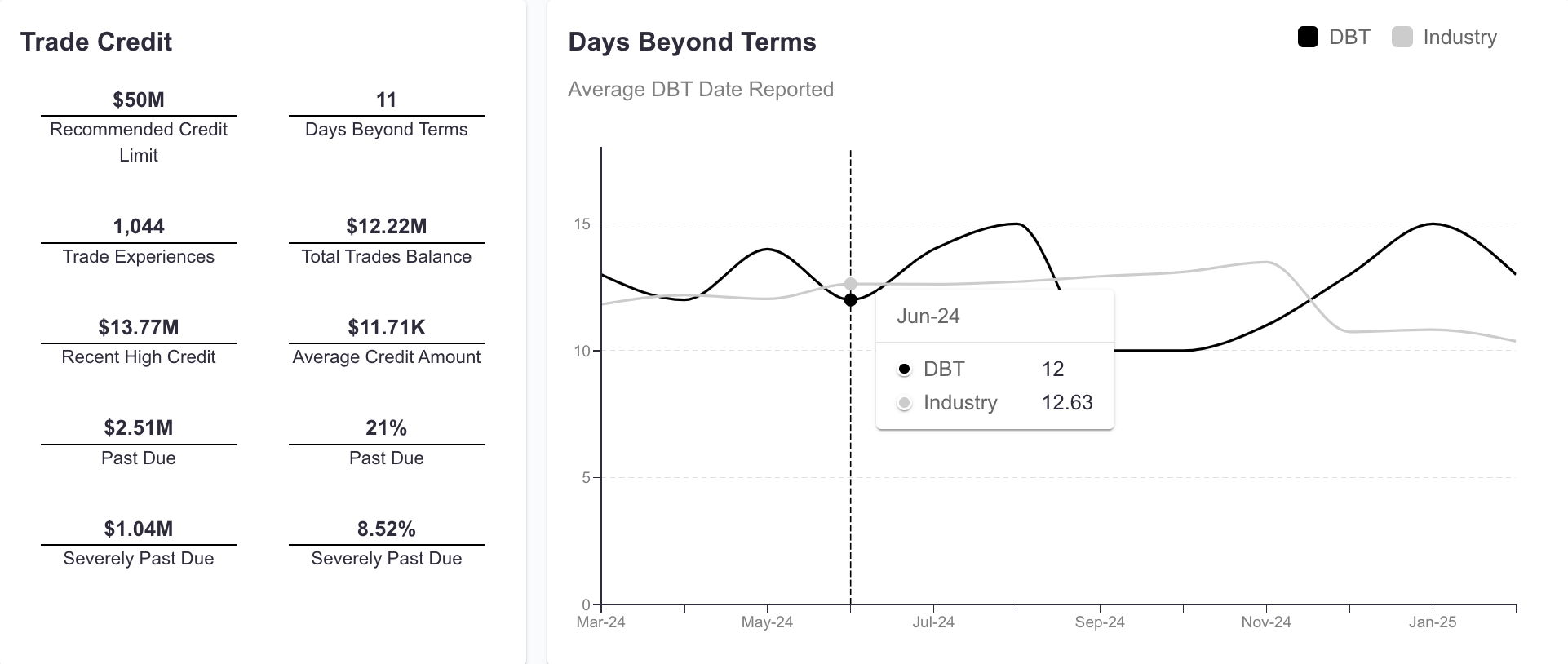

Trade Credit Metrics & DBT are included to give you high-level insights into historical trade behavior and lines. Hovering over the "Days Beyond Terms" chart will give you a view into this customer's DBT compared to their industry.

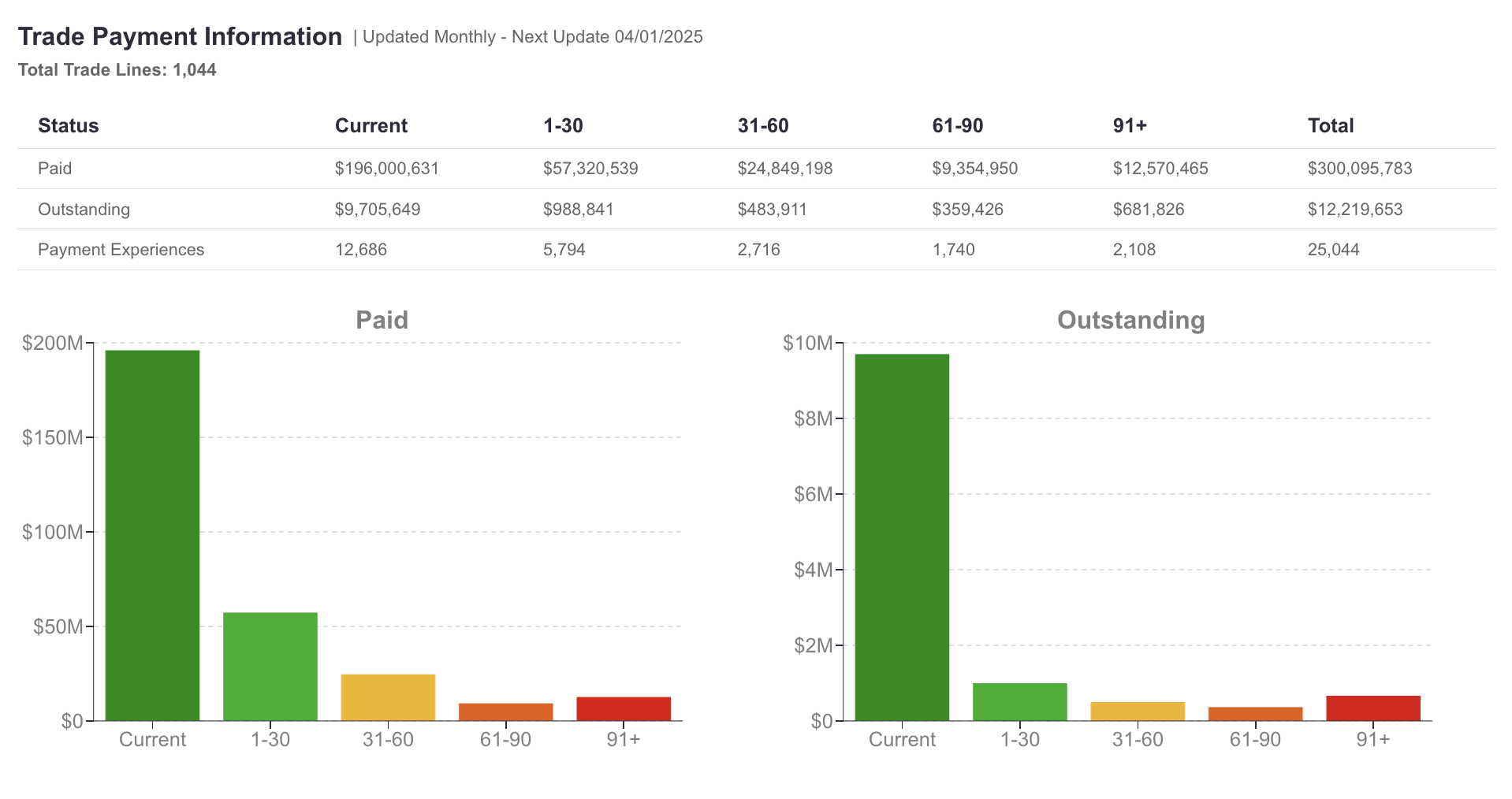

Trade Payment Information is updated monthly and included in this section. You'll find key details, including overall, group, and historical insights to support your assessments.

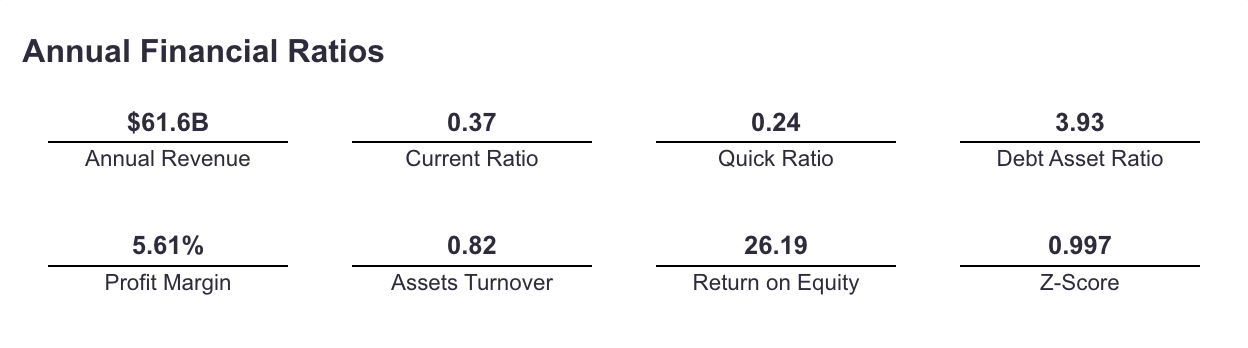

Public Company Financials are included in this section if applicable to the customer. This includes funding details and annual financial ratios, which are updated as new data becomes available to support your assessments.

People

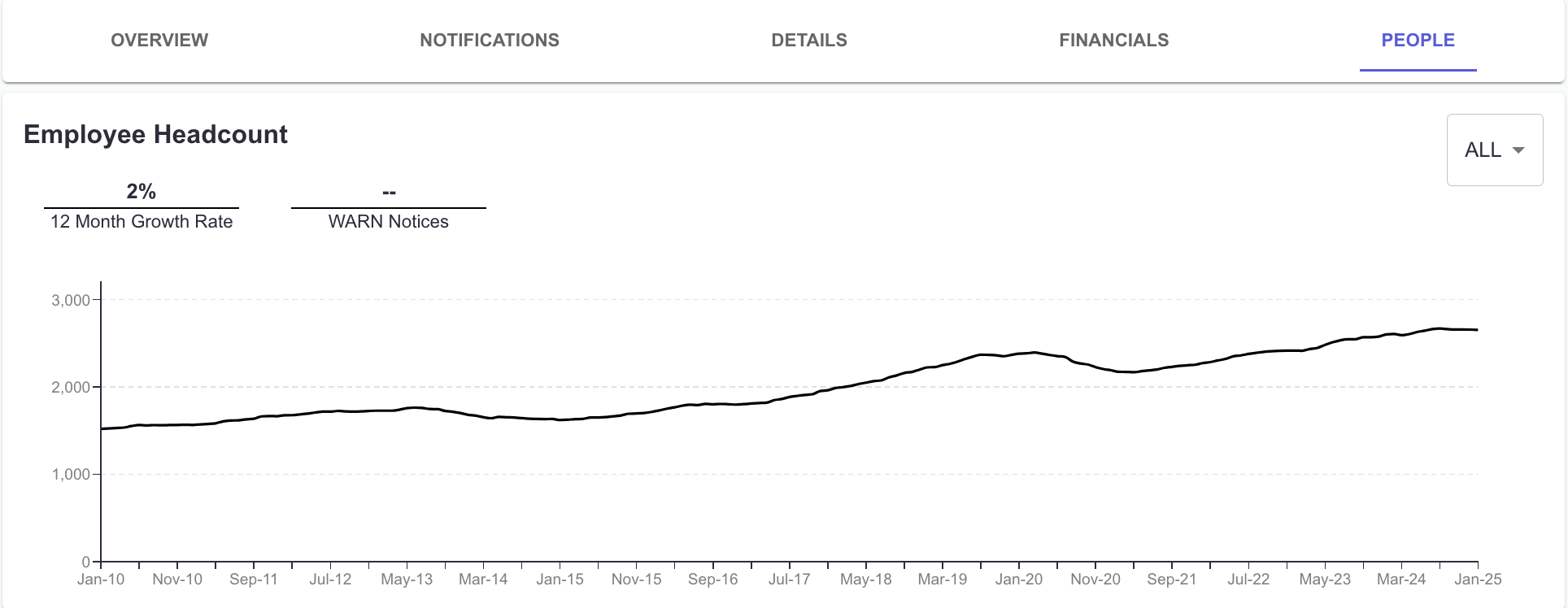

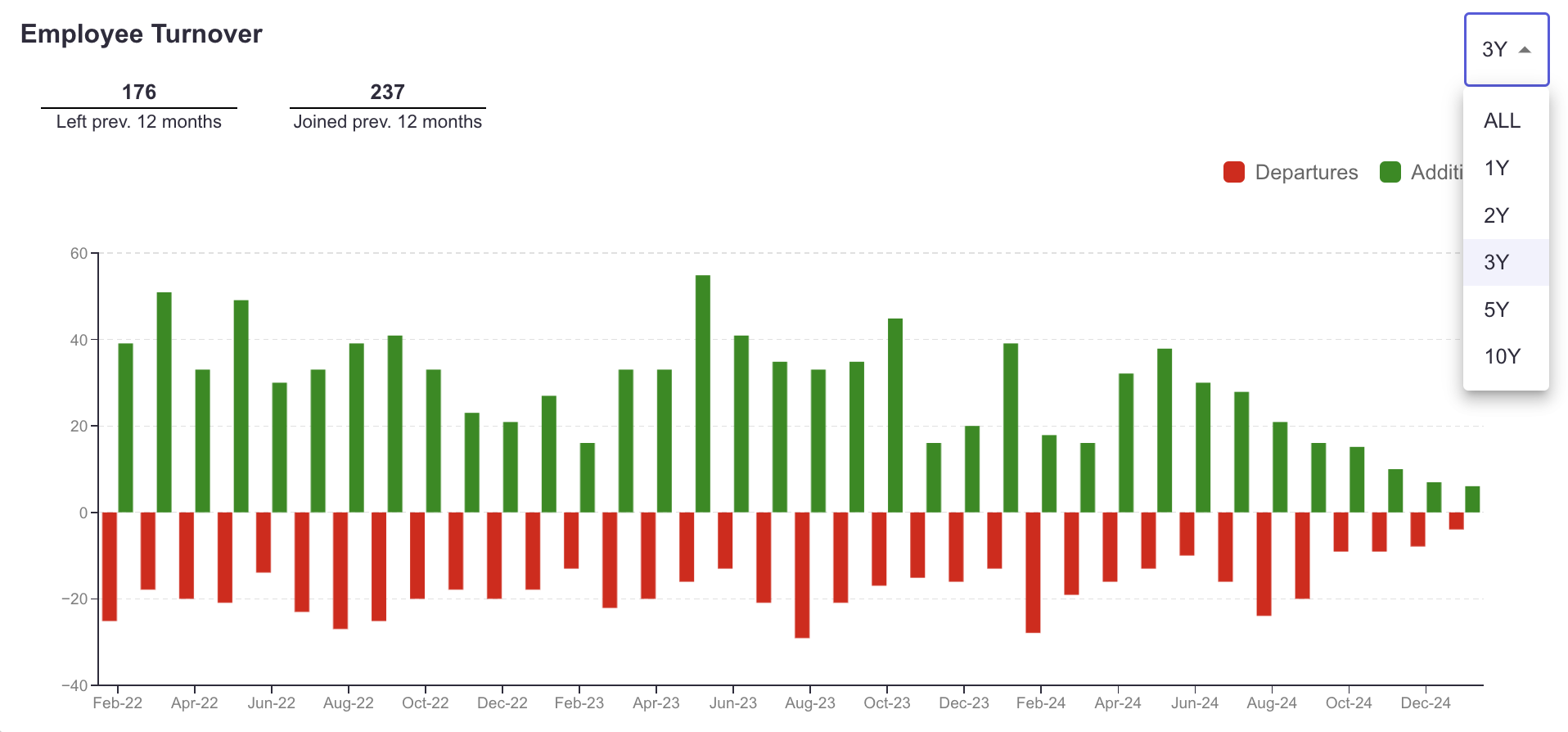

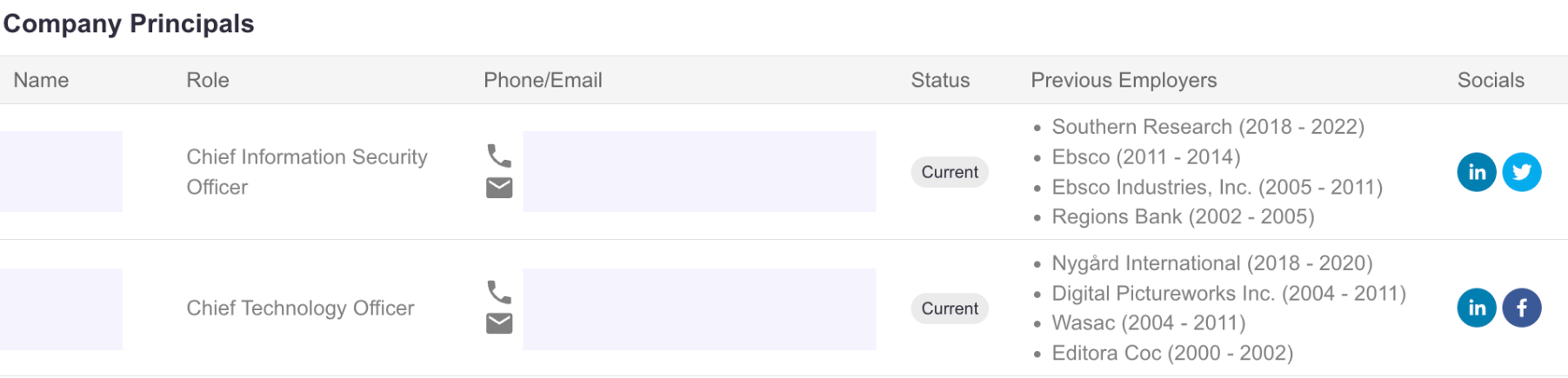

Here you will find Headcount, Employee Turnover, and Company Principals.

Headcount can be filtered by shorter time spans, and detailed insights are available when you hover over the chart line. Key metrics, such as the 12-month growth rate, are also included.

Employee Turnover tracks headcount changes for a company over specific periods, highlighting trends in departures and new additions.

Company Principals lists key executives along with their roles, contact information, current status, previous employers, and social presence. Social links are clickable for easy access during your assessment.

Questions? Email support@creditpulse.com to reach out team.