Managing Your Credit Application

Below is a step-by-step guide of best practices and how to manage credit applications received via Credit Pulse.

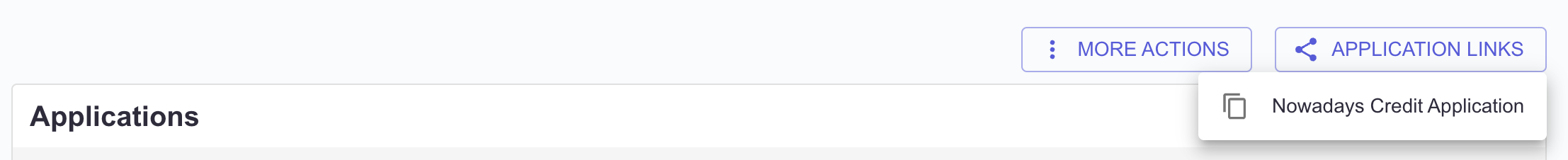

Sending Application Links

Each credit application has a unique link, accessible within the Credit Pulse portal. To access it, go to the Applications tab and click Application Links.

Select your application to view and copy the link.

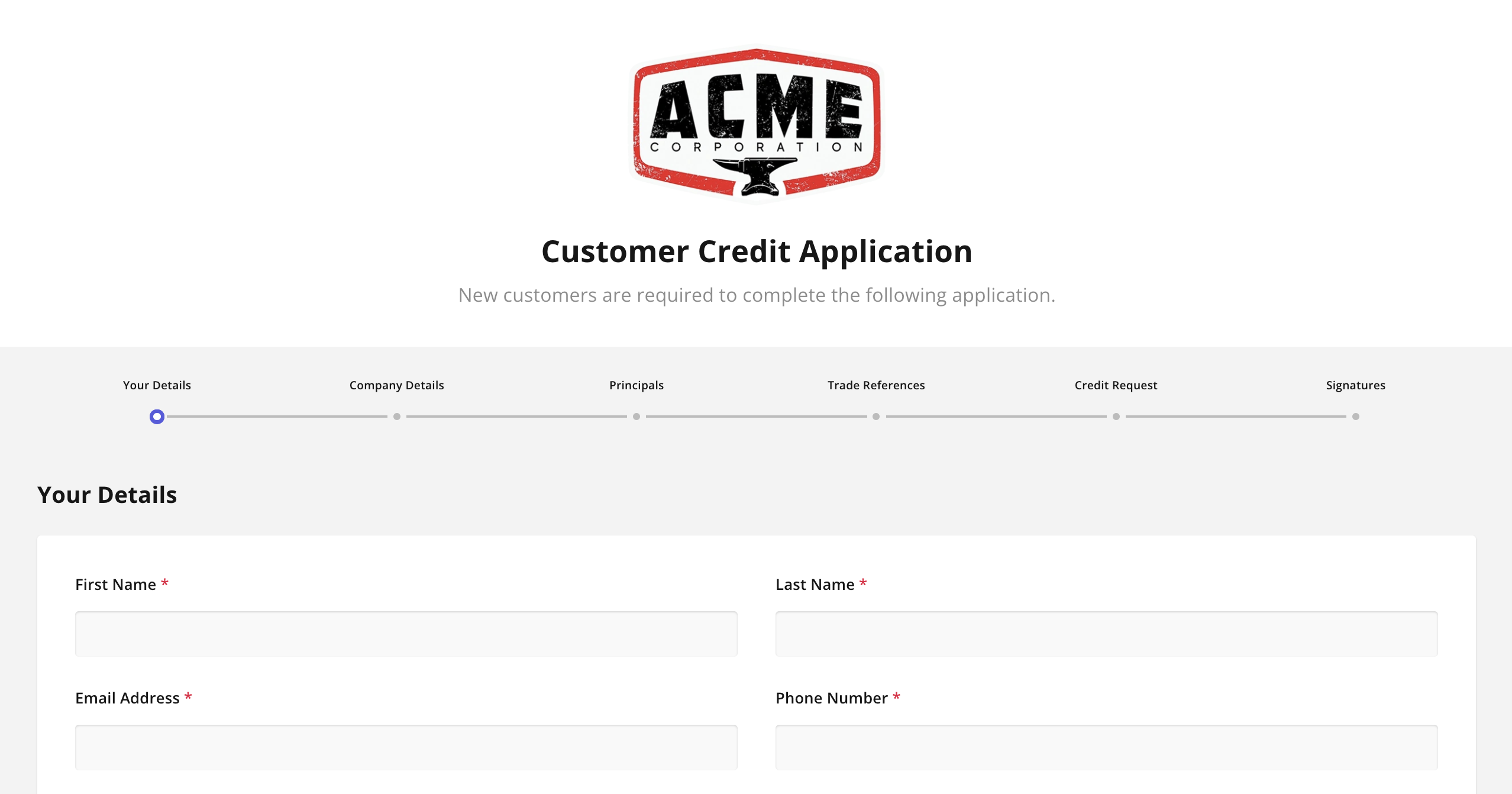

This link will take you to your custom application. Applications can be built to your needs, including required fields, custom & conditional logic, and attachment support.

Status Tracking

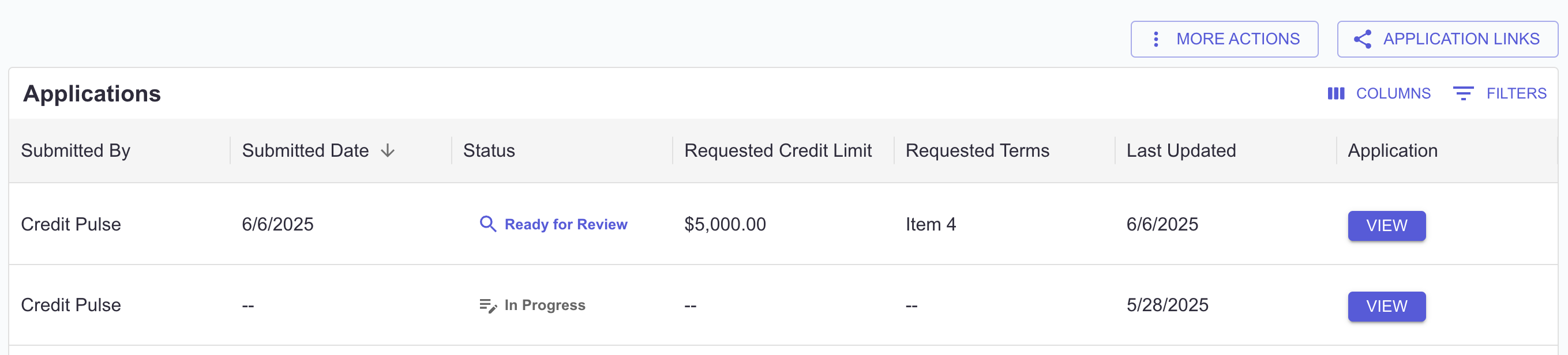

In the Applications tab, you can monitor the status of every credit application—whether it’s just been started or fully completed. Statuses include:

In Progress: The customer has started the application

Awaiting Signature: The application was sent to an authorized signer

Submitted: The application is completed with trade references needing attention

Awaiting Trade References: Trade references have been sent, but not completed

Ready for Review: The application and trade references have been completed

Approved: The application has been reviewed and approved

Rejected: The application has been reviewed and denied

Use this view to stay on top of application progress and take action when needed.

Review Completed Applications

Each use will receive an email when an new application has been submitted:

In Credit Pulse, the application status will be marked Ready for Review, click the View button to open and review its details.

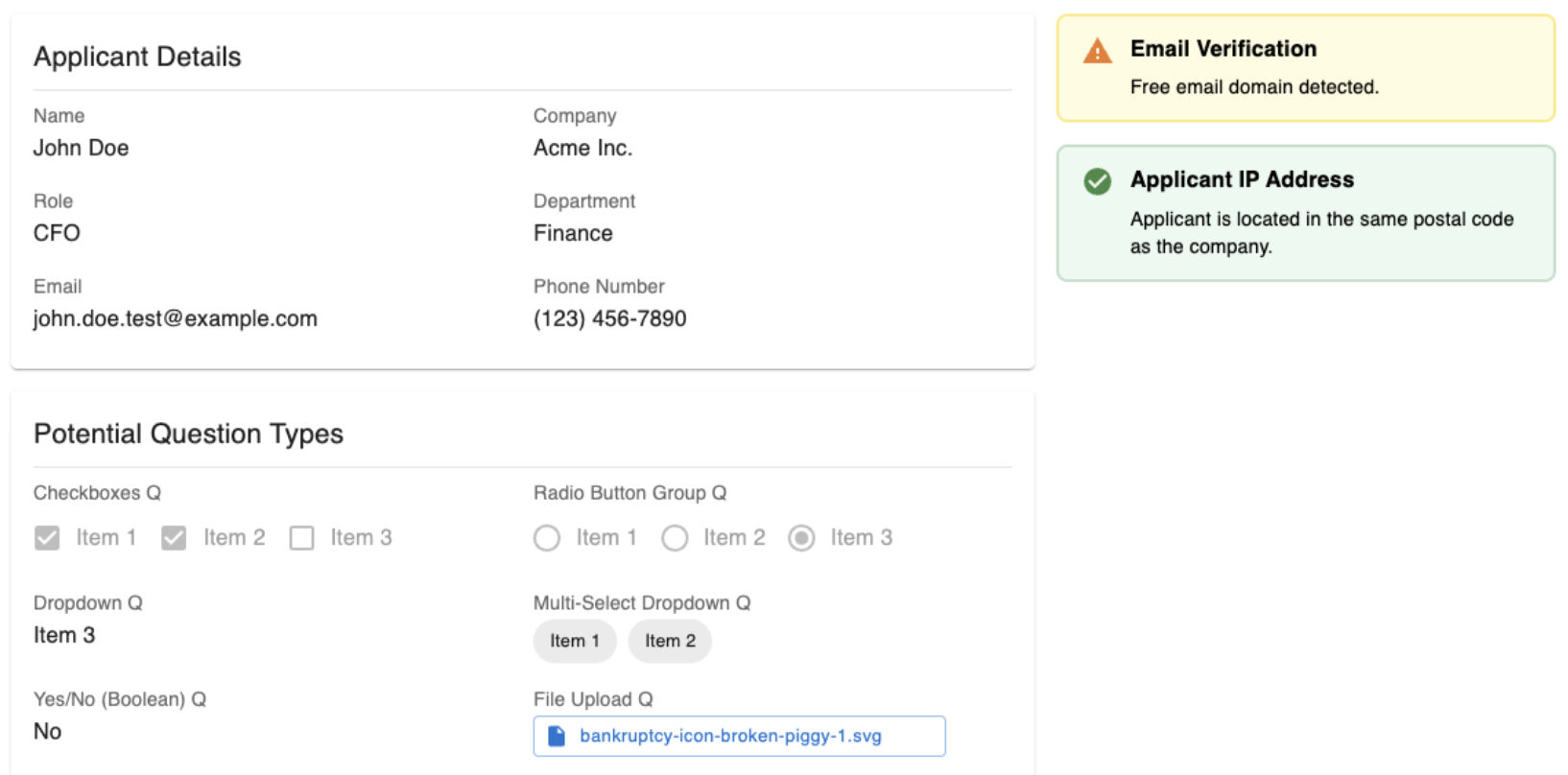

If any files were uploaded—such as permits or voided checks—they’ll appear in the application. You can open, download, and save them locally if needed.

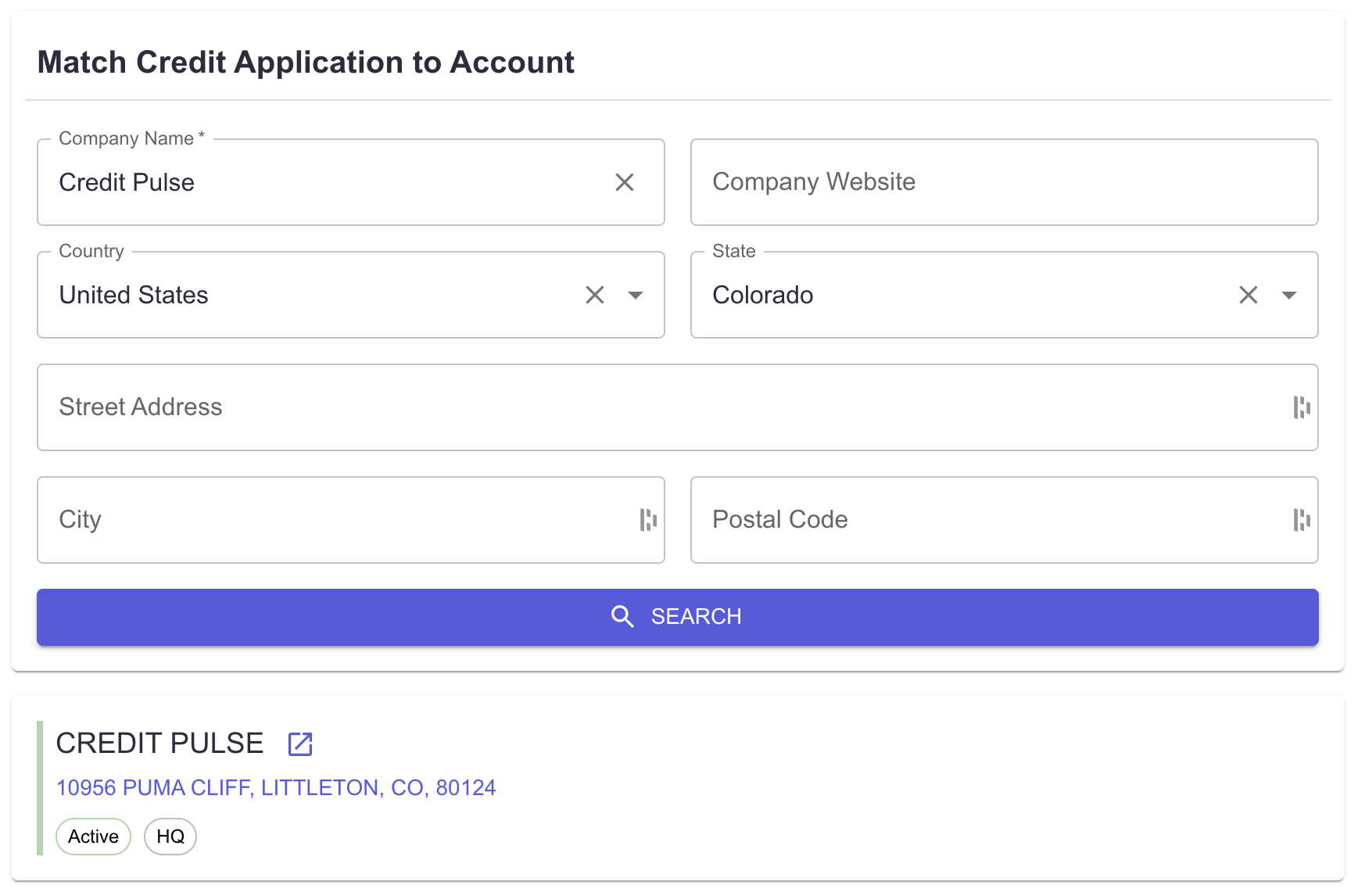

Match Account Record

To unlock predictive insights and review the applicant in more detail, you’ll need to match the credit application to an account record.

Click Match to Account at the top of the application, then search for the company. From the search results, select the correct account to complete the match.

If the account doesn’t already exist in your portfolio, you’ll be prompted to add it. Simply click Yes to proceed.

Review Fraud Checks

If any suspicious activity or potential fraud is detected, it will be flagged directly in the application. These alerts highlight areas that may require further review before making a decision.

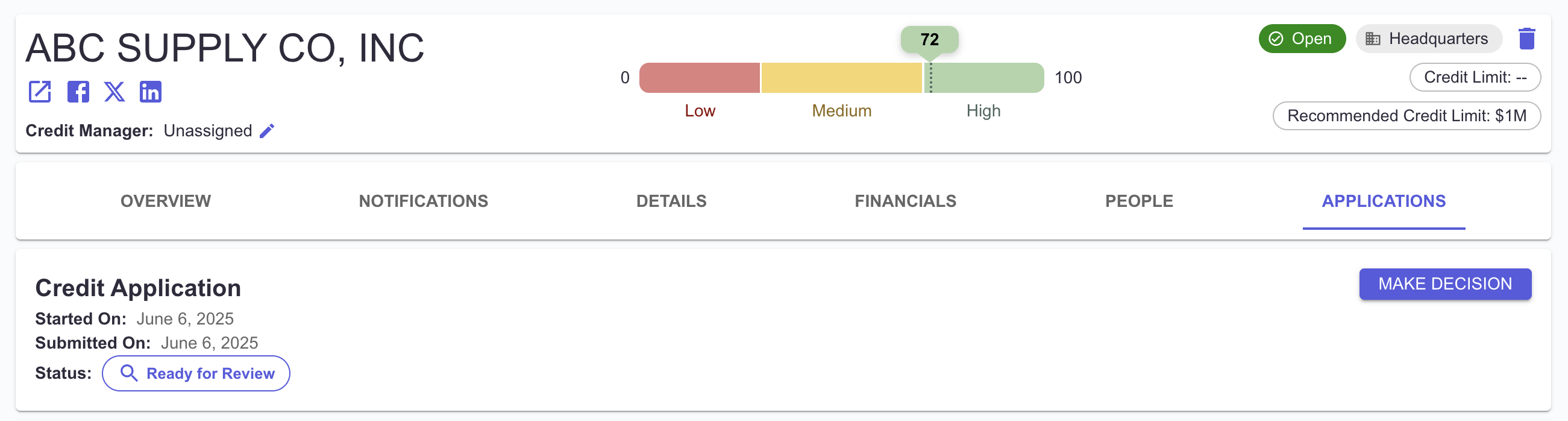

Account Review

Once the application is matched to an account, you’ll unlock Credit Pulse’s predictive insights—giving you the clarity to assess risk, set credit limits, and make confident decisions.

You’ll be able to review:

Pulse Score: A comprehensive risk profile based on all available signals

Health Score: The probability of insolvency or bankruptcy within the next 12 months

Payment Score: The likelihood of late or missed payments

Additional data is available in the tabs above, offering deeper insight into what’s driving each score and supporting your credit evaluation.

From here, you’re ready to make a call—approve, decline, or request more info with confidence.

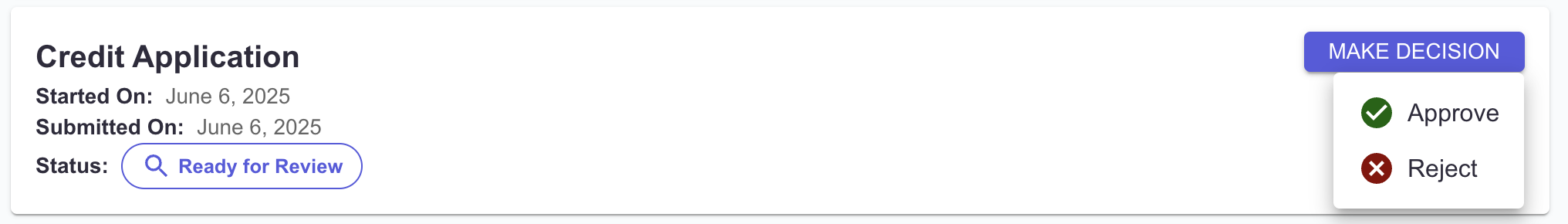

Application Decision

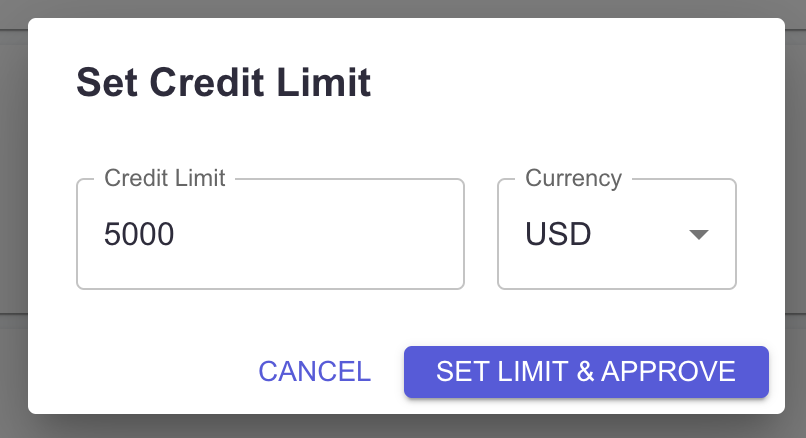

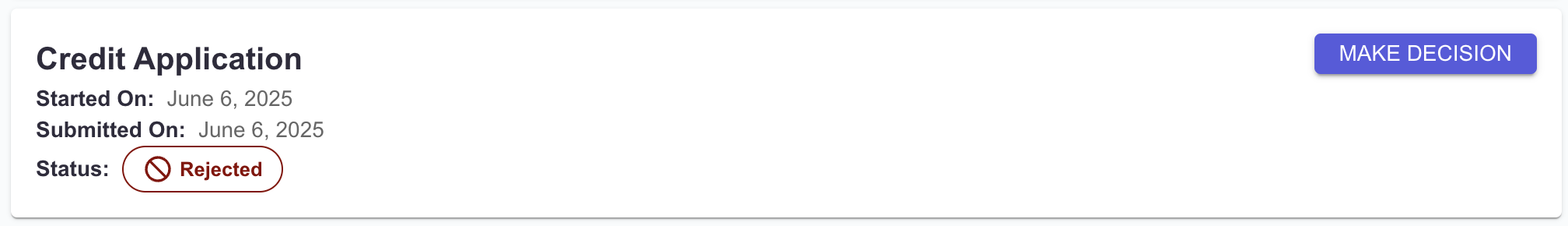

When you're ready to make a decision, click the Make Decision button on the application. You’ll be presented with two options: Approve or Reject.

If you Approve the application, you’ll be prompted to enter a credit limit and select a currency. Then, click Set Limit & Approve to finalize.

If you Reject the application, the status will update to Rejected. You can still revisit the decision later by clicking Make Decision again

Questions? Email support@creditpulse.com to reach out team.